Houston Housing Market Offers More Options and Slightly Lower Prices for Homebuyers in November 2025

As the holiday season approached, the Houston housing market offered both buyers and sellers reasons to take pause and reassess. According to the Houston Association of Realtors’ (HAR) November 2025 Housing Market Update, local real estate conditions continued shifting toward balance—marked by expanding inventory, slight moderation in prices, and continued demand across select segments.

Single-Family Home Sales See Modest Dip, But Market Remains Active

In November 2025, single-family home sales declined for the first time since April, falling 2.3% year-over-year. A total of 6,347 units were sold compared to 6,499 the previous November. Despite the decrease, pending sales jumped 7.2%, indicating strong buyer interest moving into year-end.

Home values showed a slight adjustment. The median home price dipped 1.5% to $325,000, while the average price rose 0.8% to $422,552—reflecting increased activity in Houston’s high-end housing market. The luxury sector (homes priced at $1 million and above) grew by 23.4% year-over-year and now represents 4.7% of all sales activity.

In contrast, homes priced between $250,000 and $999,999, which make up 72% of sales, experienced slower movement. The list-to-sale price ratio dropped to 92.2% in November, marking the lowest level since HAR began tracking this metric in 2001.

“Houston’s housing market is setting into a balanced pace,” said HAR Chair Shae Cottar with LPT Realty. “Buyers now have more time, more options and a little more breathing room to negotiate. Sellers are still attracting offers, but realistic pricing and expectations make all the difference.”

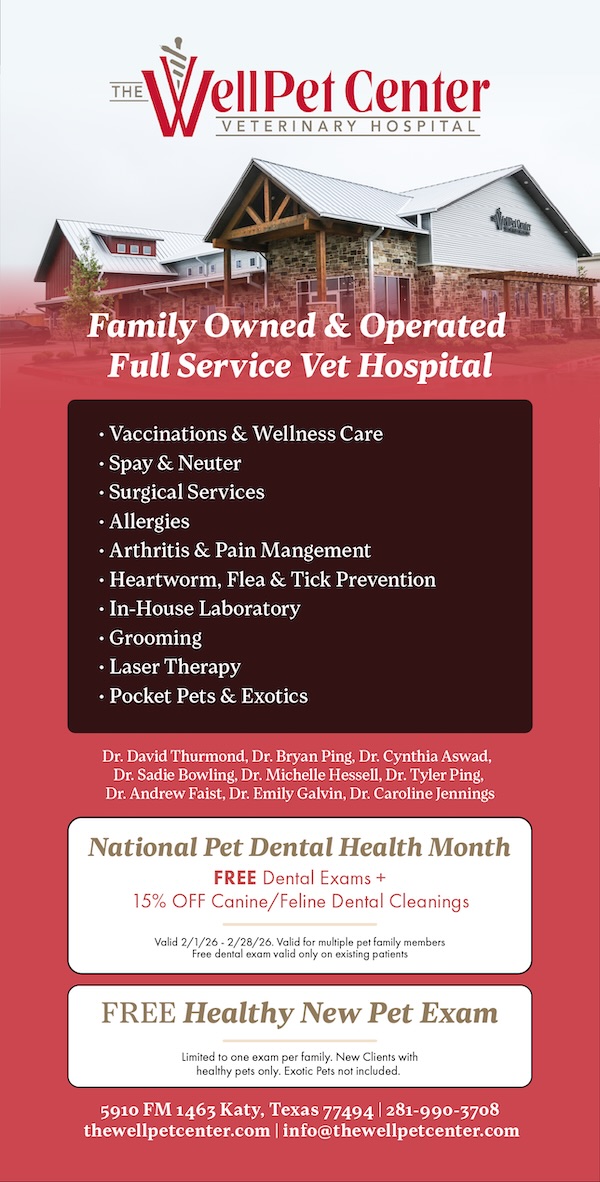

Mobile Sidebar Ad

Affordability Improves with Lower Mortgage Rates

Affordability improved slightly this fall. The average mortgage rate decreased from 6.81% in November 2024 to 6.24% in November 2025. That shift, combined with a 20% down payment, translated into monthly savings of $123.67—or about $1,484 annually—on a median-priced home.

Buyers also had more choices this November. Total active single-family home listings increased 21.0% year-over-year to 36,620, and months of inventory expanded from 4.3 to 5.0. Homes spent an average of 60 days on the market, up from 53 last year.

By the Numbers: Single-Family Housing Segments

Here’s how individual price categories performed:

- $1 - $99,999: 89 transactions (down 2.2%)

- $100,000 - $149,999: 146 transactions (up 10.6%)

- $150,000 - $249,999: 1,240 transactions (up 3.6%)

- $250,000 - $499,999: 3,561 transactions (down 6.4%)

- $500,000 - $999,999: 1,009 transactions (down 7.3%)

- $1M and above: 301 transactions (up 23.4%)

Existing single-family homes accounted for 4,131 closings in November—a 0.8% decline compared to the same time last year. Average prices remained steady at $439,743, with the median price holding at $325,000.

Townhome and Condo Sales Slide Despite Price Gains

Townhouse and condominium sales dropped 8.3% year-over-year, with 341 units sold in November 2025 compared to 372 the year before. However, pricing moved in the opposite direction. The average price increased by 10.7% to $268,628, and the median price rose 2.4% to $230,000. Inventory climbed significantly, reaching an 8.0-month supply—up from 5.8 months last year.

Mobile Sidebar Ad

Overall Market Performance Across Greater Houston

- Total property sales: Down 2.7% (7,475 units sold)

- Total dollar volume: Down 0.8% ($3.05 billion)

- Active listings: Up 19.4% (57,961 available properties)

- Single-family months inventory: 5.0 months (up from 4.3)

- Average days on market (DOM): 60 days (up from 53)

Multi-family properties and country homes saw year-over-year growth, even as sales in most other categories slowed.

With mortgage rates easing and inventory increasing, many prospective buyers in Houston are seeing new opportunities in what’s becoming a more balanced real estate market. At the same time, sellers may need to adjust expectations to remain competitive in a landscape shaped by negotiation, flexibility, and price sensitivity.

Tiffany Krenek has been on the My Neighborhood News team since August 2021. She is passionate about curating and sharing content that enriches the lives of our readers in a personal, meaningful way. A loving mother and wife, Tiffany and her family live in the West Houston/Cypress region.

Tiffany Krenek has been on the My Neighborhood News team since August 2021. She is passionate about curating and sharing content that enriches the lives of our readers in a personal, meaningful way. A loving mother and wife, Tiffany and her family live in the West Houston/Cypress region.