Harris County Department of Education Approves Slight Tax Rate Reduction for 12th Consecutive Year

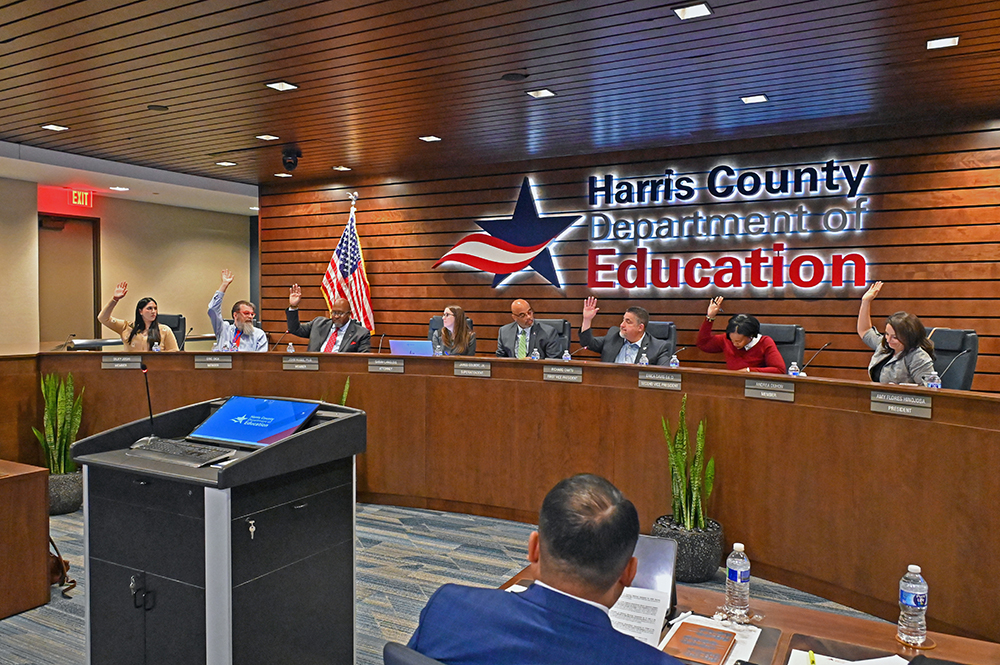

The Harris County Department of Education (HCDE) Board of Trustees has voted to reduce its property tax rate for the twelfth year in a row. During its October 2025 meeting, the board approved a rate of $0.004798 per $100 of taxable property value for the 2025–2026 fiscal year, a slight decrease from the previous year’s rate of $0.004799.

For homeowners with an assessed property value of $250,000 and a standard homestead exemption, the newly adopted rate equates to a property tax bill of just under $12 annually for HCDE services. Individual tax amounts may still vary based on changing property values.

According to officials from HCDE, the department has lowered its tax rate by 31% since 2013, which they estimate has resulted in an average savings of $4.55 for homeowners with a $250,000 home over that period.

Mobile Sidebar Ad

“HCDE continues to be good stewards of taxpayer dollars for Harris County residents and our business model has allowed us to reduce the tax rate while maximizing services,” said Superintendent James Colbert Jr. “This is a demonstration of our dedication to serve at-risk populations and results in a win for students, educators, stakeholders and the HCDE community.”

The tax rate is approved annually in the fall, following the receipt of certified property appraisal rolls from the Harris Central Appraisal District. These rolls provide the basis for calculating property taxes across Harris County. Bills are then distributed to property owners beginning in October.

The Harris County Department of Education provides services to school districts throughout the county, including early childhood education, special education support, professional development for educators, and alternative learning programs. HCDE is one of several taxing entities in the region, with its rate typically among the lowest on local tax bills.

Mobile Sidebar Ad

As homeowners across Texas continue to monitor rising property values and related tax implications, HCDE’s tax rate adjustment reflects one of the incremental changes that may affect overall annual property tax expenses.

More details about HCDE’s budget, operations, and services are available at hcde-texas.org.

Tiffany Krenek has been on the My Neighborhood News team since August 2021. She is passionate about curating and sharing content that enriches the lives of our readers in a personal, meaningful way. A loving mother and wife, Tiffany and her family live in the West Houston/Cypress region.

Tiffany Krenek has been on the My Neighborhood News team since August 2021. She is passionate about curating and sharing content that enriches the lives of our readers in a personal, meaningful way. A loving mother and wife, Tiffany and her family live in the West Houston/Cypress region.