Greater Houston Rental Trends: What 2025 Taught Us About Lease Prices, Demand, and Inventory

Houston’s rental market closed out 2025 with a tale of two property types: strong, steady growth in single-family rentals and a late-year rebound for townhomes and condos after early sluggishness. According to the Houston Association of Realtors’ (HAR) newly released Rental Market Update, the year offered renters more options, developers valuable insights, and landlords a relatively stable pricing environment.

Single-Family Rentals Lead the Way in 2025

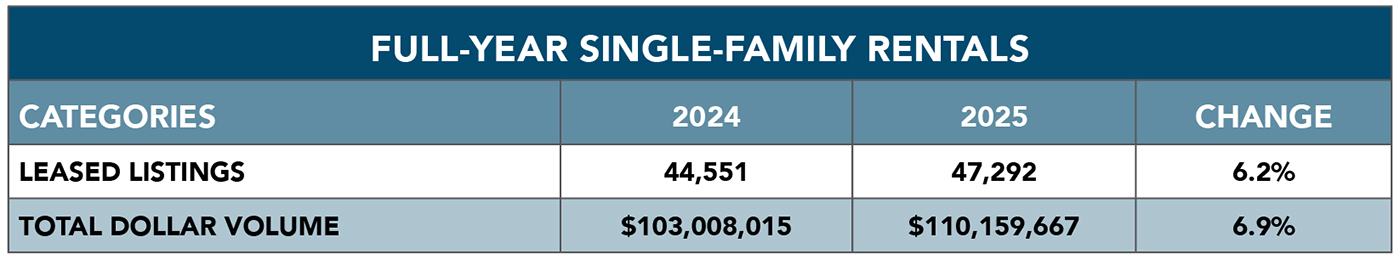

Single-family homes saw a solid boost in both activity and inventory. A total of 47,292 homes were leased in 2025 across the Greater Houston Area, up 6.2% from 44,551 in 2024. The total dollar volume followed suit, climbing nearly 7% to $110.2 million.

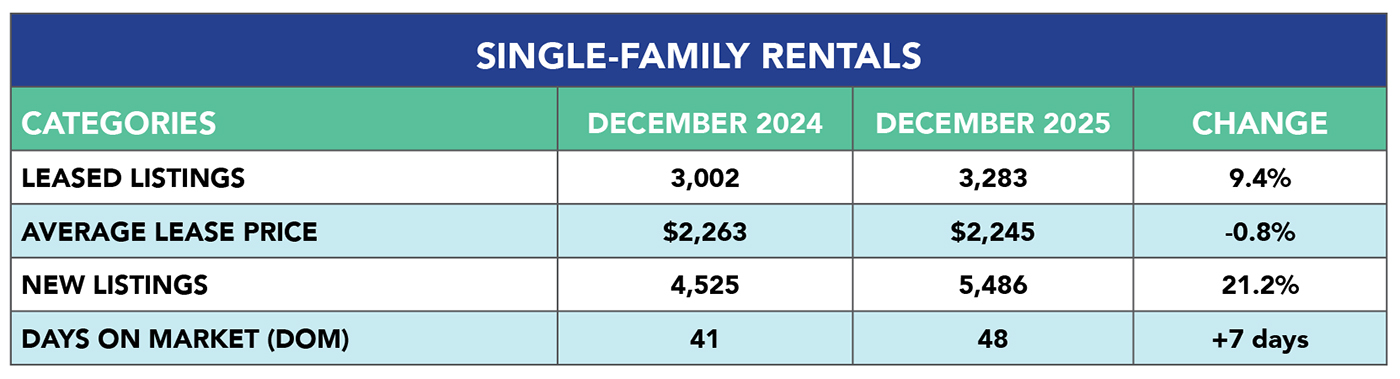

In December alone, single-family lease activity jumped 9.4%, with 3,283 leases signed, compared to 3,002 in December 2024. Rental inventory also surged, as 5,486 new listings hit the market—marking a 21.2% increase year-over-year.

Despite the higher volume, lease prices held steady. The average lease price dipped slightly by 0.8%, to $2,245 in December, continuing a trend of flat pricing that has persisted for over half the year. Meanwhile, the average number of Days on Market (DOM) rose from 41 to 48 days, a sign that renters may be taking more time to compare options amid increased inventory.

“A growing supply of rental properties gave renters more flexibility in 2025, while steady demand kept leasing activity moving at a healthy pace without putting upward pressure on prices,” said HAR Chair Theresa Hill with Compass RE - Houston. “Even as interest rates ease, rental demand is expected to remain strong this year.”

Mobile Sidebar Ad

Build-to-Rent Communities Expand Across Houston

One of the driving forces behind the expanding single-family rental market in Houston has been the continued rise of Build-to-Rent (BTR) communities—master-planned developments built specifically for long-term renters. These neighborhoods offer detached homes with modern amenities, professional property management, and maintenance-free living, combining the comfort of single-family homes with the convenience of renting.

Several such communities have emerged across Greater Houston in recent years:

Katy: Detached Rental Neighborhoods

-

The Landing at Morton Ranch: 156 detached homes north of Clay Road. Features private yards, attached garages, and proximity to the Grand Parkway.

-

Covey Homes Tamarron: 213 stand-alone houses within the Tamarron master plan; includes full access to the community’s resort-style pools and clubhouses.

-

Summerwell Sunterra: Modern detached rental homes and townhomes with access to the famous Sunterra Crystal Lagoon and white sand beaches.

-

Villas at Sunterra: An ONM Living community featuring 2-, 3-, and 4-bedroom detached single-family houses with professional lawn maintenance.

-

Camillo Lakes (SimplyHome): A Legend Homes development in Northwest Katy focused on large 4-bedroom layouts and lakeside views.

West Houston & Energy Corridor

-

Enclave at Mason Creek (Wan Bridge): Luxury gated enclave of detached 3- and 4-bedroom homes specifically designed for professionals. Features 10-foot ceilings and private yards near I-10.

-

Edison Park (Wan Bridge): A boutique community of detached houses and modern townhomes located near Highway 6, offering a "lock-and-leave" lifestyle.

Tomball & Cypress: The Northwest BTR Hub

-

Tricon Willow Creek (Tomball): Detached farmhouse-style homes with fully fenced yards, smart technology, and an on-site neighborhood dog park.

-

Cottage Green (HMF Americana): A unique, gated community in Tomball featuring detached cottages with large front porches and private pocket parks.

-

Wingspan at Bridgeland (Cypress): High-end detached houses and casitas with immediate access to 250 miles of trails and the Bridgeland Central retail hub.

-

Willow at Marvida (Cypress): Brand-new detached homes featuring modern finishes and access to the Marvida "Island Amenity" complex.

Spring: North Houston Job Corridor

-

The Everstead at Windrose: Eco-friendly, detached homes with private yards near Windrose Golf Club; NGBS Green Certified for sustainability.

-

Sycamore Heights (Greystar): A brand-new enclave of luxurious detached houses on the edge of The Woodlands, featuring a resort-inspired pool and a "Paw Spa."

-

Camden Woodmill Creek: Professionally managed detached homes with private driveways, located minutes from Market Street and The Woodlands Mall.

This growing trend aligns with the data: more renters are seeking larger homes with outdoor space, especially as remote work and flexible lifestyles continue to influence housing preferences post-pandemic. BTR communities help meet this demand with purpose-built designs, while also attracting interest from institutional investors and developers looking to capitalize on a shifting rental landscape.

Townhomes and Condos See Year-End Uptick After Slower Year

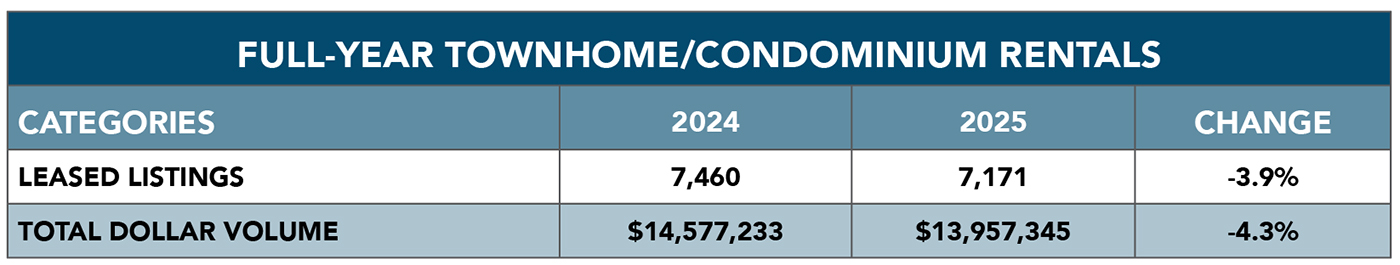

The rental market for townhomes and condominiums told a slightly different story in 2025. Full-year performance declined 3.9%, totaling 7,171 leased listings compared to 7,460 in 2024. Likewise, the total dollar volume dropped 4.3% year-over-year to just under $14 million.

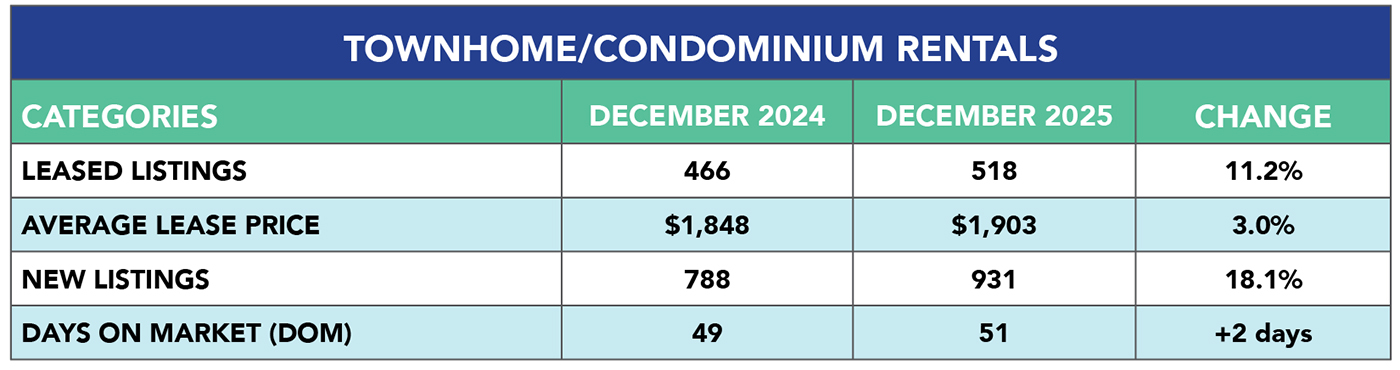

But the December numbers reveal a more encouraging trend. Townhome and condo rentals rose 11.2% from the previous December, with 518 leases signed, up from 466. The average lease price climbed to $1,903, marking a 3.0% gain, while the DOM increased modestly by two days, from 49 to 51 days.

This late-year rally suggests momentum may be shifting in favor of multifamily rentals heading into 2026.

Mobile Sidebar Ad

What This Means for Renters, Landlords, and Developers in Greater Houston

For renters, 2025 offered more choices and price stability—especially in the single-family market. Increased availability meant more flexibility and less competition for listings. For landlords, especially those with single-family properties, the year brought consistent leasing activity even as some properties took a bit longer to rent.

For developers and investors, the diverging trends highlight an opportunity to monitor the growing interest in townhome and condo rentals that could rebound further in 2026. The year-end lift in multifamily leasing, paired with rising lease prices, suggests that demand may be catching up to supply again.

Looking Ahead

As Houston continues to expand and evolve, the rental market is likely to remain a vital part of the region’s housing ecosystem. HAR’s 2025 data reveals a market that’s growing in size and complexity, with opportunities for stakeholders across the spectrum—from residents seeking affordable homes to developers looking to meet emerging demand.

Tiffany Krenek has been on the My Neighborhood News team since August 2021. She is passionate about curating and sharing content that enriches the lives of our readers in a personal, meaningful way. A loving mother and wife, Tiffany and her family live in the West Houston/Cypress region.

Tiffany Krenek has been on the My Neighborhood News team since August 2021. She is passionate about curating and sharing content that enriches the lives of our readers in a personal, meaningful way. A loving mother and wife, Tiffany and her family live in the West Houston/Cypress region.