As $129M MUD Bond Launches Heritage Bend, Fulshear Grapples with the Pressures of Growth

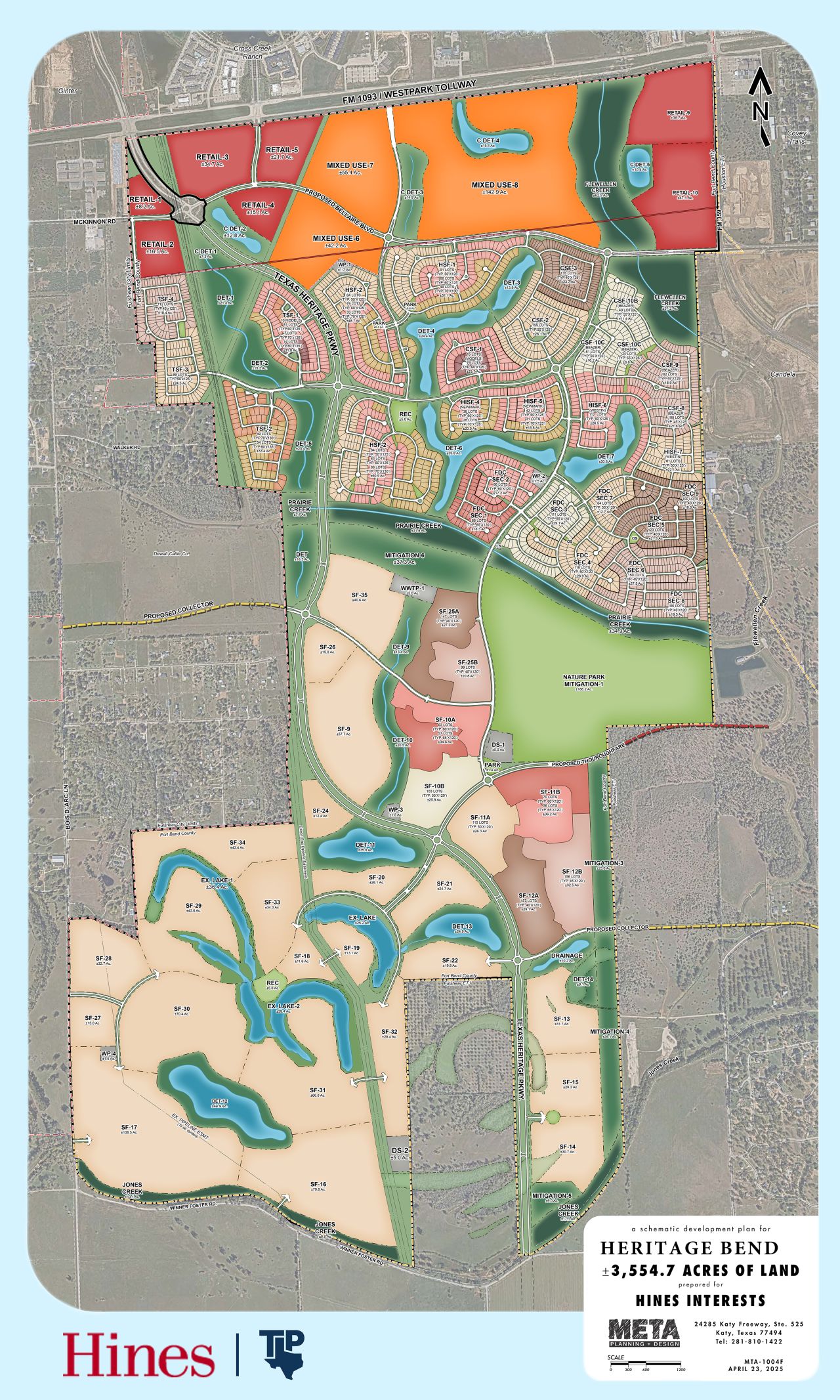

A major financing deal will pave the way for thousands of new homes in Fort Bend County, as SAMCO Capital Markets closed a $129.2 million MUD receivable bond to fund initial infrastructure work for developer Hines’ new master-planned community, Heritage Bend, located just south of Cross Creek Ranch off FM 1093.

The project, which spans nearly 3,000 acres, was first announced in January 2025 and is planned to include nearly 3,000 homes in its initial phase, ultimately building out to more than 7,000 residences. According to Michael Libera, Managing Director at SAMCO, the transaction "represents the largest MUD receivable financing to date" where bond proceeds will fund infrastructure construction.

Builders who have secured lots in the first phase include Highland Homes, Toll Brothers, Perry Homes, Lennar, Coventry Homes, Beazer, Newmark, and Westin Homes, with initial home construction expected in 2027.

Mobile Sidebar Ad

Housing Demand Continues in West Fort Bend

Market data from HAR.com confirms that Fulshear’s growth trajectory remains strong. In Q2 2025, the Fulshear/South Brookshire/Simonton region ranked #20 on HAR’s “50 Hottest Communities” list. In July 2025, the average home price in Fulshear reached $531,919, with a median price of $460,759 and 176 total transactions—homes spent just 26.5 days on market, on average.

Heritage Bend’s location between FM 1093 and the Texas Heritage Parkway places it within close reach of the Energy Corridor and West Houston, adding to the appeal for commuters and new residents seeking suburban home options.

Fulshear Faces a Crossroads: Balancing Growth and Livability

While housing demand is clearly high, the pace of development has triggered mounting concern across Fulshear about whether infrastructure is growing fast enough to support it.

At a May 2, 2025 Planning and Zoning Commission meeting, city staff and residents debated a proposed rezoning of 45 acres on McKinnon Road from estate residential to commercial. The item was ultimately denied, but the conversation revealed deeper issues: limited traffic capacity on rural roads, lack of dedicated funding for improvements, and tension between Fulshear’s original low-density zoning intent and the rapid commercial and residential growth unfolding today.

A schematic development plan for Heritage Bend, spanning approximately 3,554.7 acres south of FM 1093 in Fort Bend County. The site map, shared alongside Michael Libera’s announcement of the $129.2 million MUD bond transaction, illustrates the planned mix of residential, retail, and green space uses across the Hines-led community. Image courtesy of META Planning + Design, dated April 23, 2025.

A schematic development plan for Heritage Bend, spanning approximately 3,554.7 acres south of FM 1093 in Fort Bend County. The site map, shared alongside Michael Libera’s announcement of the $129.2 million MUD bond transaction, illustrates the planned mix of residential, retail, and green space uses across the Hines-led community. Image courtesy of META Planning + Design, dated April 23, 2025.That same pressure was evident in the August 1, 2025 P&Z meeting, where the Commission considered 12 new development items—from commercial plats to multi-phase subdivisions. In one case, a proposed townhome development in the city’s extraterritorial jurisdiction (ETJ) was denied, after staff noted that city utility service capacity had not been verified—a reminder that services like water and sewer remain limited outside formal city boundaries.

In another agenda item, the city approved a new telecommunications tower at the FM 1093 water plant, citing the need to address growing strain on cell service. City staff acknowledged that “as development within the City of Fulshear and the surrounding area continues to increase, so does the strain on cellular services.”

What the Bond Means—and What It Doesn’t

The $129.2 million bond closed by SAMCO is a MUD receivable bond, meaning it is backed by future reimbursement payments from the area’s Municipal Utility District (MUD). While this financing mechanism allows Hines to build infrastructure like roads, drainage systems, and utilities upfront without placing the cost directly on taxpayers, it doesn’t directly address broader city-level infrastructure needs—such as regional traffic improvements, drainage upgrades beyond project boundaries, or public safety staffing.

As Fort Bend County continues to grow—it’s projected to nearly double in population by 2050, reaching close to 2 million residents—communities like Fulshear are grappling with how to balance the demand for new homes with the long-term livability and sustainability of existing neighborhoods.

Mobile Sidebar Ad

A Tipping Point for Growth

Heritage Bend is far from the only large-scale project shaping the area. But it arrives at a moment when residents, planners, and elected officials are more aware than ever of the challenges that come with sustaining rapid growth.

Infrastructure bond financing can deliver essential foundations for new neighborhoods—but it’s just one piece of a much larger puzzle in Fulshear’s future.

Tiffany Krenek has been on the My Neighborhood News team since August 2021. She is passionate about curating and sharing content that enriches the lives of our readers in a personal, meaningful way. A loving mother and wife, Tiffany and her family live in the West Houston/Cypress region.

Tiffany Krenek has been on the My Neighborhood News team since August 2021. She is passionate about curating and sharing content that enriches the lives of our readers in a personal, meaningful way. A loving mother and wife, Tiffany and her family live in the West Houston/Cypress region.