Williamsburg Settlement 2024 Maintenance Assessment to Remain at $750

At its September 19, 2023 meeting your Board of Directors finalized the 2024 Williamsburg Settlement Homeowners’ Association budget. After review and discussion of both the reserve requirement for the long-term sustainability of our subdivision as well as the ongoing operational expenditures the decision was made to hold the assessment for 2024 at its present value of $750.00 per home. This time, to fund the installation and operation of license plate reading cameras at our five entrances the budget shows that our predicted expenses will exceed revenue by $29,167. This shortfall can be accommodated by a reduction in our operating reserve and avoids the $30 increase that would have been required to fund the operating expense of the cameras during 2024.

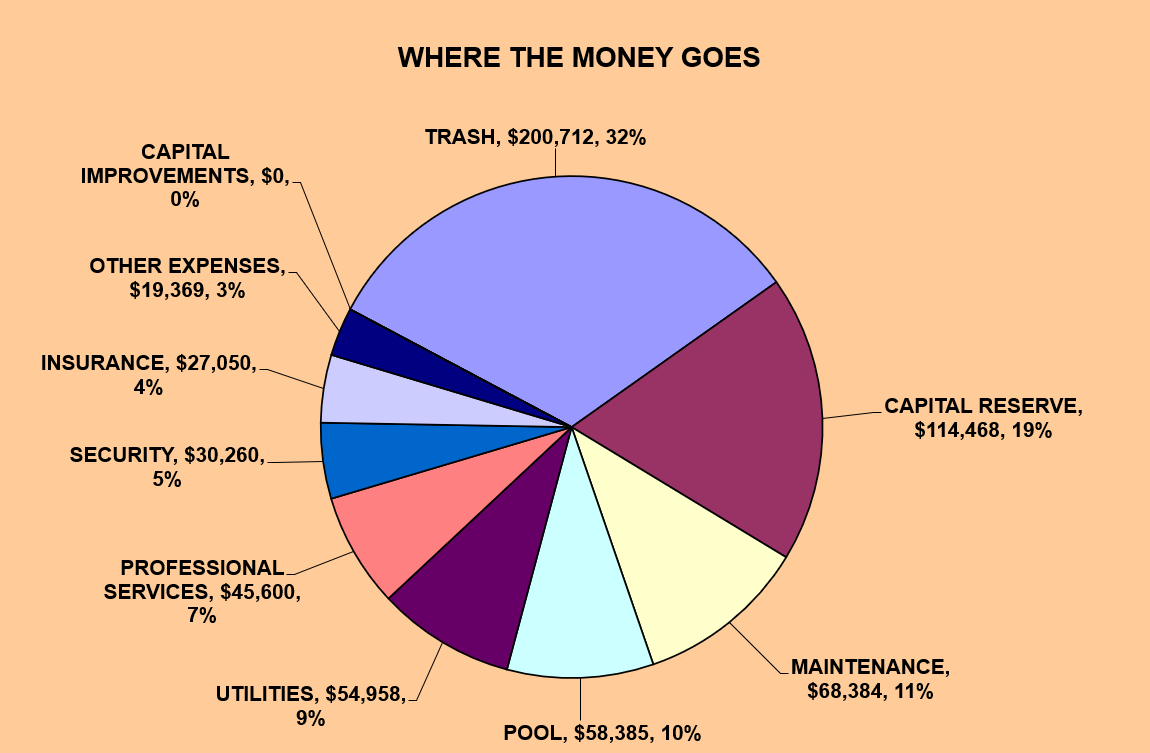

The table below gives the amount forecasted in each income and cost category followed by a pie chart illustrating the relative significance of each. This data together with that for the previous four years is also shown in the Budget section of the Association website https://www.wsmaonline.org where you can review it at any time.

The 2024 budget has been developed to ensure that all anticipated expenditures can be met while maintaining the long-term fiscal integrity of our Association’s finances.

|

2024 APPROVED BUDGET

|

|

|

|

|

|

2024 MAINTENANCE FEE RATE

|

$750

|

|

|

|

|

|

|

|

INCOME

|

|

|

Maintenance Fee Income

|

575,953

|

|

Delinquency

|

(5,722)

|

|

Interest on Fees

|

1,400

|

|

Bank Interest

|

11,152

|

|

Reimbursed Attorney Fees

|

2,000

|

|

Club Income

|

3,300

|

|

Miscellaneous

|

1,950

|

|

TOTAL REVENUE

|

590,033

|

|

|

|

|

EXPENSES

|

|

|

MAINTENANCE

|

|

|

Sprinkler System Repair

|

5,184

|

|

Landscape Contract

|

29,340

|

|

Landscape Extras

|

16,822

|

|

Forced Mows

|

350

|

|

Pest Control

|

2,758

|

|

Cleaning Services and Supplies

|

650

|

|

Tennis Court Maintenance

|

400

|

|

Playground Maintenance

|

1,600

|

|

Basketball Court Maintenance

|

20

|

|

Clubhouse Repairs

|

2,520

|

|

Entry Maintenance

|

840

|

|

Fence Repairs

|

7,000

|

|

Flag Maintenance

|

900

|

|

TOTAL MAINTENANCE

|

68,384

|

|

|

|

|

POOL

|

|

|

Pool Contract

|

51,385

|

|

Pool Maintenance & Repairs

|

5,400

|

|

Pool Tags

|

1,600

|

|

TOTAL POOL

|

58,385

|

|

|

|

|

PROFESSIONAL SERVICES

|

|

|

Audit and tax Return

|

2,000

|

|

Legal

|

3,000

|

|

Legal - Deed Restriction Enforcement

|

2,000

|

|

Legal - Maintenance Fee Collection

|

7,200

|

|

Administrative Services

|

31,400

|

|

TOTAL PROFESSIONAL SERVICES

|

45,600

|

|

|

|

|

UTILITIES

|

|

|

Power - Street Lights

|

32,196

|

|

Power - Recreation Center

|

10,981

|

|

Power - Entry

|

1,143

|

|

Telephone

|

888

|

|

Water/Sewer Clubhouse

|

5,030

|

|

Water – Entrances & Cul-de-sacs

|

4,720

|

|

TOTAL UTILITIES

|

54,958

|

|

|

|

|

TRASH

|

|

|

Trash and Recycling

|

200,712

|

|

TOTAL TRASH

|

200,712

|

|

|

|

|

SECURITY

|

|

|

License Plate Readers at Entrances

|

30,260

|

|

TOTAL TRASH

|

30,260

|

|

|

|

|

INSURANCE

|

|

|

Insurance

|

27,050

|

|

TOTAL INSURANCE

|

27,050

|

|

|

|

|

OTHER EXPENSES

|

|

|

Record Storage Fee

|

540

|

|

Office Supplies

|

312

|

|

Copies

|

3,200

|

|

Postage

|

4,400

|

|

Distribution

|

700

|

|

Deed Restriction Expenses

|

1,500

|

|

Community Events

|

3,800

|

|

Welcoming Committee Expenses

|

200

|

|

Christmas Decorations

|

2,500

|

|

Memberships & Web Site

|

424

|

|

Miscellaneous/Contingency

|

1,793

|

|

TOTAL OTHER EXPENSES

|

19,369

|

|

|

|

|

CAPITAL IMPROVEMENTS

|

|

|

Including Operating Reserve

|

0

|

|

TOTAL CAPITAL IMPROVEMENTS

|

0

|

|

|

|

|

TAXES

|

|

|

Property Tax

|

11

|

|

TOTAL TAXES

|

11

|

|

|

|

|

TOTAL OPERATING EXPENSES

|

504,729

|

|

|

|

|

RESERVE

|

|

|

Capital Reserve Budget Allocation

|

114,468

|

|

TOTAL EXPENSES PLUS RESERVE

|

619,197

|

|

|

|

|

PROFIT / (LOSS)

|

(29,167)

|