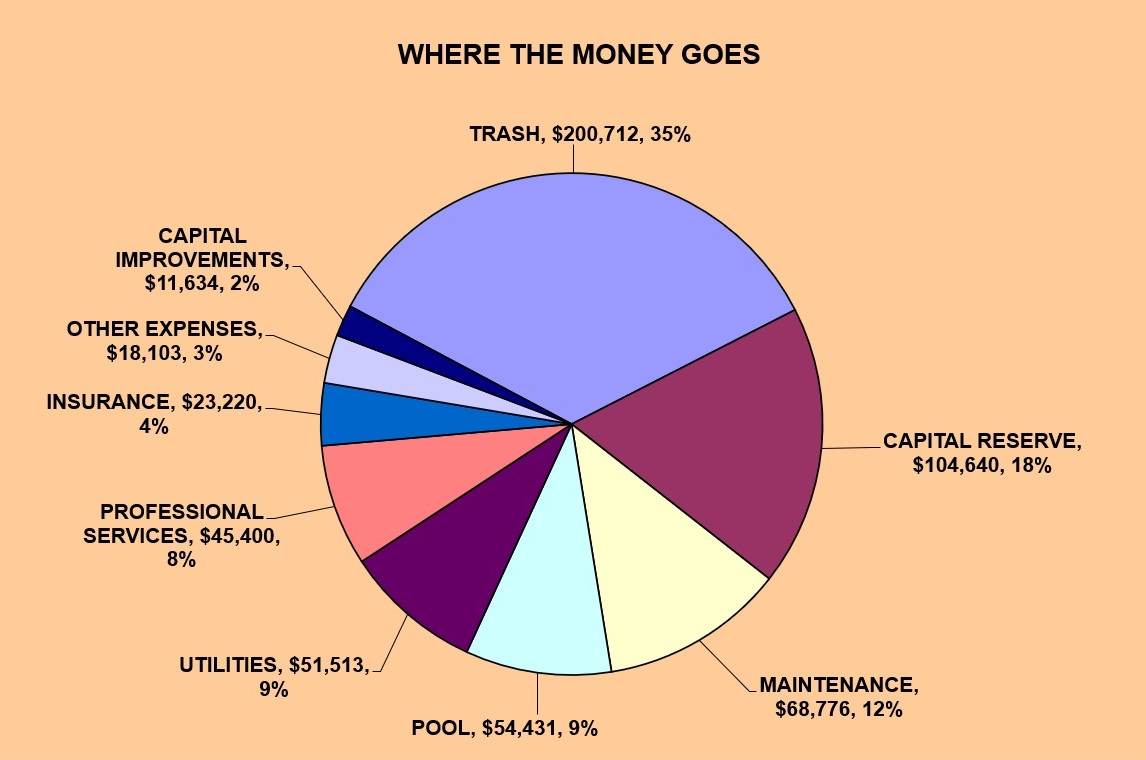

2023 Maintenance Assessment to Remain $750

2023 APPROVED BUDGET

INCOME |

|

|

Maintenance Fee Income |

572,196 |

|

Delinquency |

(5,715) |

|

Interest on Fees |

1,400 |

|

Bank Interest |

3,884 |

|

Reimbursed Attorney Fees |

2,000 |

|

Club Income |

3,125 |

|

Miscellaneous |

1,550 |

|

TOTAL REVENUE |

578,440 |

|

|

|

EXPENSES |

|

|

MAINTENANCE |

|

|

Vandalism Expenses |

500 |

|

Sprinkler System Repair |

4,716 |

|

Landscape Contract |

29,760 |

|

Landscape Extras |

19,889 |

|

Forced Mows |

350 |

|

Pest Control |

2,591 |

|

Cleaning Services and Supplies |

560 |

|

Tennis Court Maintenance |

400 |

|

Playground Maintenance |

1,600 |

|

Basketball Court Maintenance |

270 |

|

Clubhouse Repairs |

2,400 |

|

Entry Maintenance |

840 |

|

Fence Repairs |

4,000 |

|

Flag Maintenance |

900 |

|

TOTAL MAINTENANCE |

68,776 |

|

|

|

POOL |

|

|

Pool Contract |

47,431 |

|

Pool Maintenance & Repairs |

5,400 |

|

Pool Tags |

1,600 |

|

TOTAL POOL |

54,431 |

|

|

|

PROFESSIONAL SERVICES |

|

|

Audit and tax Return |

2,000 |

|

Legal |

3,600 |

|

Legal - Deed Restriction Enforcement |

2,000 |

|

Legal - Maintenance Fee Collection |

7,200 |

|

Administrative Services |

30,600 |

|

TOTAL PROFESSIONAL SERVICES |

45,400 |

|

|

|

UTILITIES |

|

|

Power - Street Lights |

31,152 |

|

Power - Recreation Center |

9,938 |

|

Power - Entry |

1,213 |

|

Telephone |

720 |

|

Water/Sewer Clubhouse |

3,790 |

|

Water – Entrances & Cul-de-sacs |

4,700 |

|

TOTAL UTILITIES |

51,513 |

|

|

|

TRASH |

|

|

Trash and Recycling |

200,712 |

|

TOTAL TRASH |

200,712 |

|

|

|

INSURANCE |

|

|

Insurance |

23,220 |

|

TOTAL INSURANCE |

23,220 |

|

|

|

OTHER EXPENSES |

|

|

Record Storage Fee |

480 |

|

Office Supplies |

255 |

|

Copies |

3,200 |

|

Postage |

4,000 |

|

Distribution |

700 |

|

Deed Restriction Expenses |

1,500 |

|

Community Events |

3,500 |

|

Welcoming Committee Expenses |

720 |

|

Christmas Decorations |

2,500 |

|

Memberships & Web Site |

383 |

|

Miscellaneous/Contingency |

865 |

|

TOTAL OTHER EXPENSES |

18,103 |

|

|

|

CAPITAL IMPROVEMENTS |

|

|

Including Operating Reserve |

11,634 |

|

TOTAL CAPITAL IMPROVEMENTS |

11,634 |

|

|

|

TAXES |

|

|

Property Tax |

11 |

|

TOTAL TAXES |

11 |

|

|

|

|

TOTAL OPERATING EXPENSES |

473,800 |

|

|

|

RESERVE |

|

|

Capital Reserve Budget Allocation |

104,640 |

|

TOTAL EXPENSES PLUS RESERVE |

578,440 |

|

|

|

|

PROFIT / (LOSS) |

0 |