Klein ISD Adopts Lowest Tax Rate in Over Three Decades, Offers Relief to Homeowners

In a decision aimed at maintaining financial stability while supporting educational services, Klein Independent School District has adopted a tax rate of $1.0119 per $100 of property valuation for the 2025 tax year. The decision, made unanimously by the Klein ISD Board of Trustees during their October 6, 2025 meeting, marks the lowest district tax rate in 33 years—and it comes at a time when many property owners are bracing for rising costs elsewhere.

Although the tax rate itself remains the same as last year’s, the overall tax levy will actually decrease, thanks to a boost in the state’s homestead exemption. For most Klein ISD homeowners, that means a smaller school district portion on their upcoming property tax bills.

“The Board’s decision to maintain the same low tax rate reflects our ongoing commitment to fiscal responsibility while continuing to prioritize student learning and staff support,” said Klein ISD Chief Financial Officer Dan Schaefer.

Mobile Sidebar Ad

Homestead Exemption Brings Additional Relief

A key driver in the reduced tax burden is the increase in the state’s homestead exemption. The exemption—which reduces the taxable value of a homeowner’s primary residence—is set to increase from $100,000 to $140,000, and up to $200,000 for seniors and disabled homeowners, pending final voter approval on the November 2025 ballot.

This means that many property owners across the district will see further reductions in their tax bills, despite the district maintaining the same tax rate.

A Closer Look at Area Tax Rates

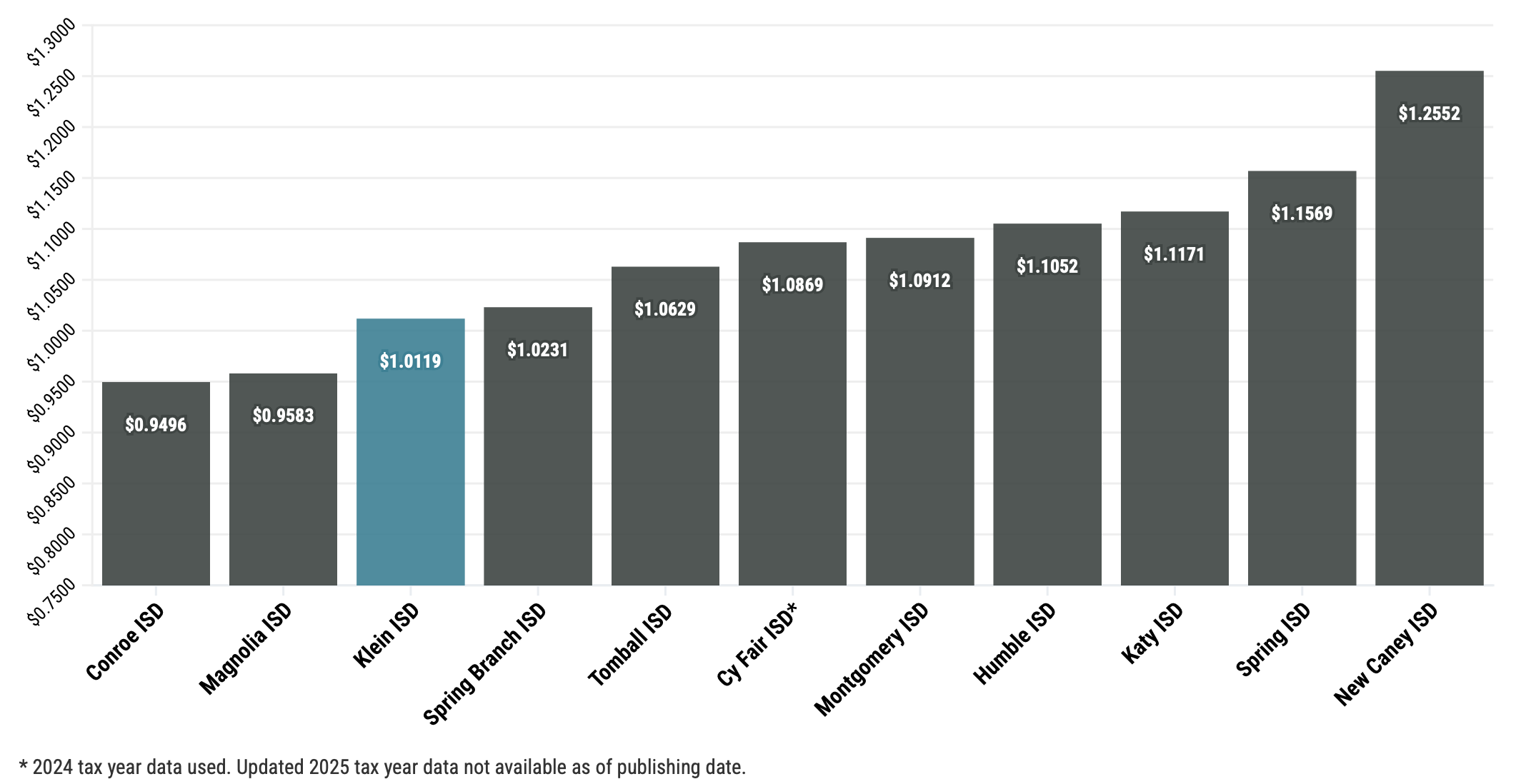

According to newly released figures, Klein ISD’s $1.0119 rate is among the lowest in the Greater Houston area, as illustrated in the comparative chart below:

(Source: Klein ISD)

(Source: Klein ISD)About the “11.59% Increase” Language

Some community members may notice language on tax documents referring to an "11.59% increase" over the state’s “no new revenue rate.” But district officials emphasize that this language is a statutory requirement, and does not reflect an actual increase in the adopted rate or in expected tax collections.

Because of falling property valuations due to the homestead exemption, Klein ISD actually expects less revenue from property taxes this year.

Supporting Students, Staff, and Schools

Despite the lower rate, the district continues to fund essential daily operations and make payments on voter-approved bonds that support the construction and renovation of school facilities. Klein ISD remains focused on student learning, teacher support, and campus safety.

“Our district’s rate remains among the lowest in the Houston area, even as we maintain high-quality educational programs and safe, modern learning environments for every student,” Schaefer added.

Mobile Sidebar Ad

What’s Next?

The newly approved tax rate takes effect immediately and will appear on property tax statements later this fall. Homeowners are encouraged to review their appraisal notices and be on the lookout for the homestead exemption ballot item this November.

For more information about Klein ISD’s budget, tax rate, or voter-approved bonds, visit kleinisd.net.

Tiffany Krenek has been on the My Neighborhood News team since August 2021. She is passionate about curating and sharing content that enriches the lives of our readers in a personal, meaningful way. A loving mother and wife, Tiffany and her family live in the West Houston/Cypress region.

Tiffany Krenek has been on the My Neighborhood News team since August 2021. She is passionate about curating and sharing content that enriches the lives of our readers in a personal, meaningful way. A loving mother and wife, Tiffany and her family live in the West Houston/Cypress region.