Houston Homebuyers Gain the Upper Hand in May 2025 as Inventory Climbs and Prices Ease

The Greater Houston housing market is showing clear signs of transformation as the city enters the summer season. A noticeable uptick in home inventory, combined with easing prices and lower mortgage rates, is delivering fresh opportunities for homebuyers in May—fueling the region’s largest year-over-year sales growth so far in 2025.

Inventory Reaches 13-Year High, Shifting Market Dynamics

According to the Houston Association of Realtors (HAR) May 2025 Housing Market Update, active listings of single-family homes swelled to 37,455 in May—a remarkable 35.0% increase from a year ago. This figure marks the highest inventory level since September 2007, when the Houston real estate market saw similar supply.

The broader housing supply, including townhomes and condominiums, rose to 58,005 available properties—a 29.4% jump from last May. The increase in listings contributed to a boost in overall property sales, which rose by 4.6% year-over-year, snapping a three-month streak of declines.

HAR Chair Shae Cottar with LPT Realty noted the psychological shift occurring among buyers:

“With more homes to choose from and prices becoming a bit more favorable, people are definitely feeling more confident and getting back out there,” said Cottar. “This shift signals to sellers that motivated buyers are engaged and eager to take advantage of the current market conditions. We anticipate this momentum will carry us into the summer months.”

Mobile Sidebar Ad

Lower Prices and Mortgage Rates Drive Buyer Affordability

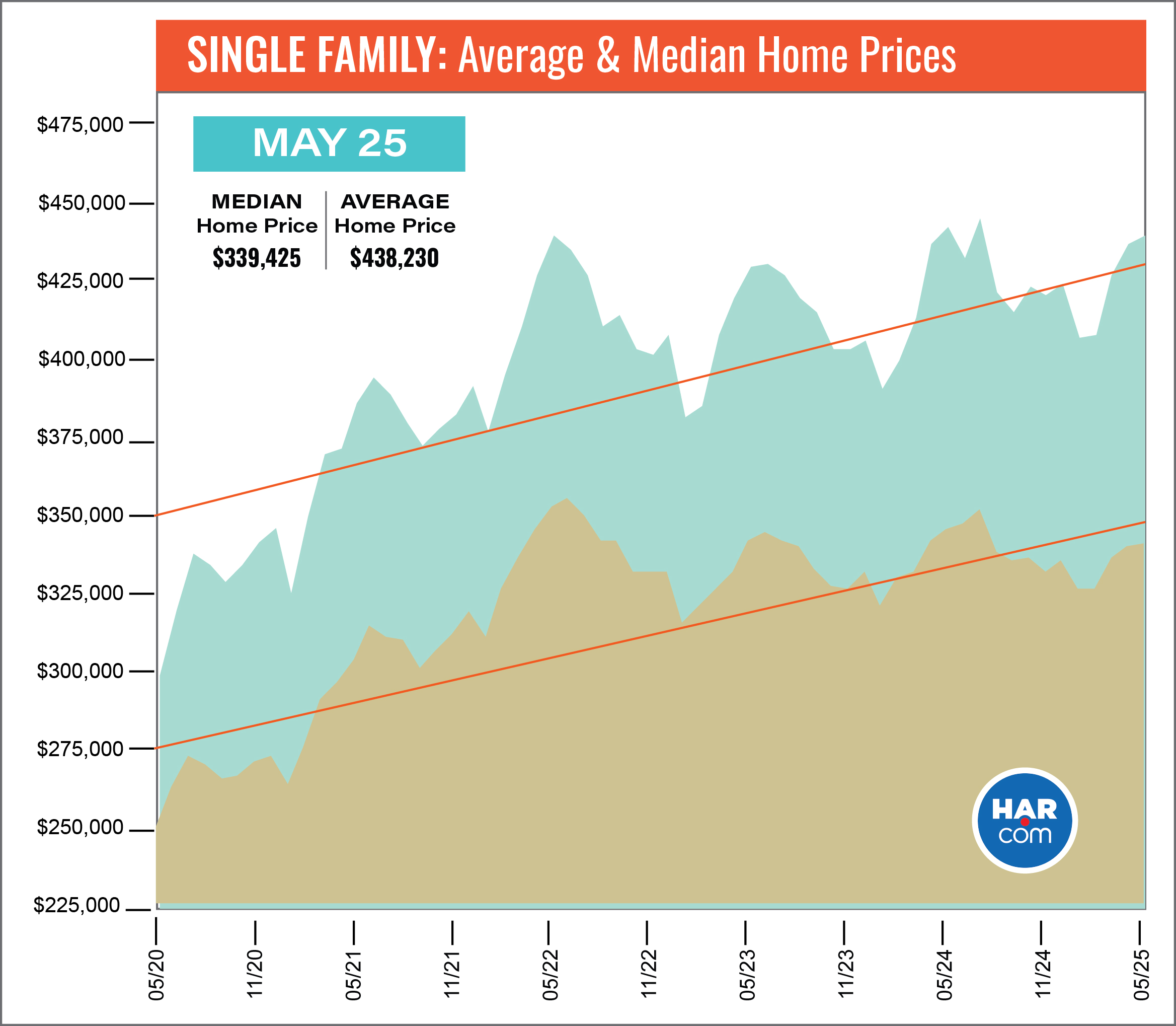

Home affordability saw modest but meaningful improvements in May, thanks to slight price reductions and easing interest rates. The median sales price for single-family homes dropped 1.2% to $339,425, while the average price decreased by 0.7% to $438,230. Price per square foot also ticked down from $182 to $180.

Adding to buyer relief, the average 30-year fixed mortgage rate decreased from 7.06% in May 2024 to 6.82% in May 2025, according to Freddie Mac’s Primary Mortgage Market Survey. That change, when coupled with lower home prices, cut the typical monthly mortgage payment (based on 20% down) from $1,839.34 to $1,773.13—a yearly savings of $794.36.

Single-Family Market Sees Sales Surge

Sales of single-family homes jumped by 6.8% year-over-year, with 9,058 closings in May compared to 8,483 a year ago. Pending sales also reflected growing momentum, increasing by 19.8%—a strong indicator of continued summer market activity.

Days on Market (DOM) lengthened slightly to 50 days, up from 46 last May, reflecting a more balanced negotiation landscape between buyers and sellers. Months of inventory also expanded to 5.2 months, well above the national average of 4.4 months, indicating further tilt toward a buyer’s market.

Notably, the strongest sales growth occurred in lower price tiers:

- Homes under $100,000: up 23.8%

- $100K–$149,999: up 18.6%

- $150K–$249,999: up 12.0%

Higher-end segments showed steadier growth, with homes priced over $1 million rising 6.3%.

(Source: HAR.com)

(Source: HAR.com)Existing Homes Hold Strong; New Listings Abound

Existing home sales increased 5.1% year-over-year, with 6,370 transactions completed. Prices in this category remained stable, with the average holding at $458,299 and the median at $345,000—unchanged from May 2024.

These gains underscore the market’s broader trend: a surge in choice and improved cost conditions, especially for first-time buyers and middle-income families.

Condominium Market Continues to Cool

While the single-family segment rebounded, Houston’s townhome and condominium market continued its downward trend. Sales fell for the fourth consecutive month, dropping 12.9% from last year. Only 485 units sold in May, compared to 557 the previous year.

Average prices dipped 5.5% to $265,903, while median prices fell 8.3% to $221,500. Inventory in this category climbed to a 7.8-month supply—its highest since September 2011—suggesting that condo buyers have more negotiating leverage than at any time in over a decade.

Looking Ahead: Summer Momentum Builds

With 58,005 total listings on the market and continued price softening, real estate professionals expect summer 2025 to remain active. The boost in buyer affordability and the abundance of homes—especially in desirable mid-range price points—suggest more families may seize the opportunity to enter or upgrade in the Houston housing market.

Mobile Sidebar Ad

For renters, eyes will be on HAR’s upcoming May 2025 Rental Home Update, slated for release Wednesday, June 18.

As homebuyers reassess their options in light of these shifting trends, one thing is clear: Houston’s housing market is entering a new era—defined by more balance, better access, and fresh opportunities.

Stay tuned with My Neighborhood News for updates on Houston's housing and rental market trends throughout the summer and beyond.

Tiffany Krenek has been on the My Neighborhood News team since August 2021. She is passionate about curating and sharing content that enriches the lives of our readers in a personal, meaningful way. A loving mother and wife, Tiffany and her family live in the West Houston/Cypress region.

Tiffany Krenek has been on the My Neighborhood News team since August 2021. She is passionate about curating and sharing content that enriches the lives of our readers in a personal, meaningful way. A loving mother and wife, Tiffany and her family live in the West Houston/Cypress region.