Texas Emergency Supplies Sales Tax Holiday Set for April 26–28: Save While You Prepare for Hurricane Season

As spring storm systems ramp up and hurricane season looms, Texas residents will have the opportunity to purchase emergency supplies tax-free from April 26 through April 28 during the state’s annual Emergency Preparation Supplies Sales Tax Holiday.

The event, launched by the Texas Legislature in 2015, offers families a financial break on essential emergency supplies like batteries, generators, flashlights, and first aid kits, encouraging early preparation for natural disasters such as hurricanes, tornadoes, floods, and wildfires.

“While we can’t know in advance when the next fire, flood, tornado or hurricane may occur, we can make sure our families, homes and businesses have the supplies they need to face these and other emergencies,” said Texas Comptroller Glenn Hegar. “Don’t wait for disaster to strike. I’m encouraging Texans to take advantage of this tax holiday to save money while stocking up for emergency situations.”

The Comptroller’s office estimates Texans will save about $2.3 million in state and local sales taxes over the three-day holiday.

Mobile Sidebar Ad

What Emergency Supplies Are Tax-Free?

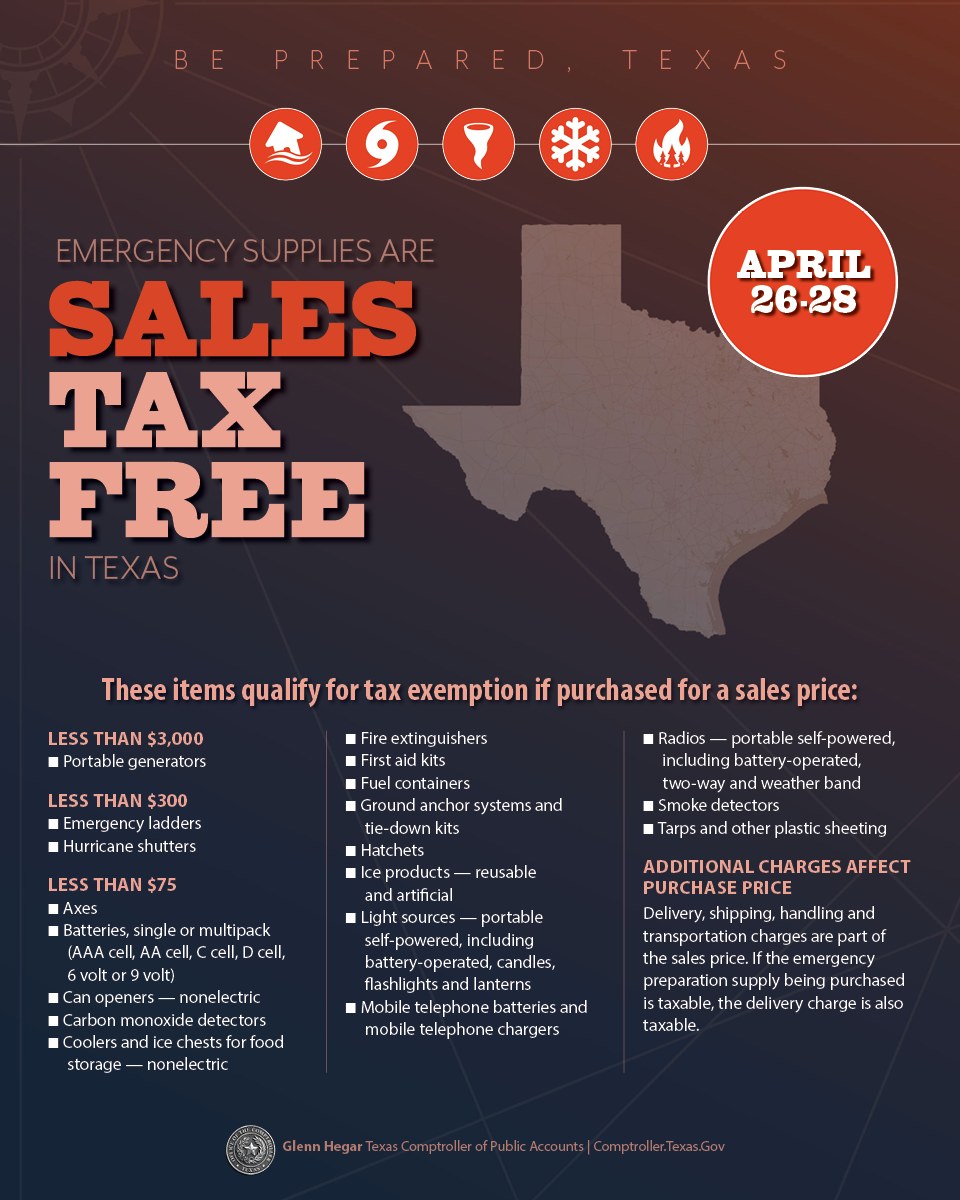

There is no limit on the number of qualifying items you can purchase, and no exemption certificate is needed. Tax-free purchases must occur between 12:01 a.m. on Saturday, April 26 and midnight on Monday, April 28.

Qualifying tax-free items include:

-

Portable generators priced under $3,000

-

Emergency ladders and hurricane shutters priced under $300

-

Batteries (AAA, AA, C, D, 6V, 9V), flashlights, lanterns, and fuel containers priced under $75

-

First aid kits, smoke and carbon monoxide detectors, mobile phone chargers, and radios

-

Non-electric coolers, tarps, tie-down kits, and manual can openers

For the full list of qualifying items, visit the Texas Comptroller’s website.

Items such as face masks, cleaning supplies, tents, chainsaws, camping stoves, and automobile batteries are not eligible for the tax exemption.

(Source: Texas Comptroller)

(Source: Texas Comptroller)Why It Matters: Preparing Ahead of Hurricane Season

According to Ready.gov, the federal government’s emergency preparedness website, creating an emergency supply kit in advance can be life-saving during natural disasters. With hurricane season in Texas officially beginning June 1, experts strongly urge residents to prepare early, as supply shortages and last-minute price hikes are common in the days leading up to a storm.

The Texas Division of Emergency Management also stresses the importance of having enough supplies to last at least 72 hours without outside assistance, especially during major weather events. Early purchasing helps avoid panic buying and ensures families have access to items that may quickly sell out when a disaster is imminent.

What to Know About Online Orders and Delivery Fees

Tax exemptions also apply to online, telephone, or mail orders, as long as the item is paid for during the sales tax holiday—even if the delivery occurs later. However, be cautious: delivery and handling charges are factored into the total sales price. If those charges push an item above the price limit, it may no longer qualify for the tax exemption.

For example, if you purchase an emergency ladder for $299 but include a $10 shipping fee, the total price becomes $309—and that purchase would no longer be tax-free.

Mobile Sidebar Ad

How to Request a Sales Tax Refund

If you accidentally pay sales tax on a qualifying emergency supply during the holiday, you can request a refund directly from the seller or use Form 00-985 to file a claim with the Texas Comptroller’s Office. For help with refund claims, call 800-531-5441, ext. 34545 or visit the Sales Tax Refunds page.

Plan Ahead and Save

The Texas Emergency Preparation Supplies Sales Tax Holiday is a timely opportunity for families to build or restock emergency kits, support public safety, and reduce the financial burden of preparing for storms and outages.

To find more information and detailed guidance on eligible items, visit the Texas Comptroller's official sales tax holiday page.

Whether you’re replacing batteries, upgrading your generator, or preparing your hurricane shutters, April 26–28 is the best time to prepare smart and save big.

Tiffany Krenek has been on the My Neighborhood News team since August 2021. She is passionate about curating and sharing content that enriches the lives of our readers in a personal, meaningful way. A loving mother and wife, Tiffany and her family live in the West Houston/Cypress region.

Tiffany Krenek has been on the My Neighborhood News team since August 2021. She is passionate about curating and sharing content that enriches the lives of our readers in a personal, meaningful way. A loving mother and wife, Tiffany and her family live in the West Houston/Cypress region.