Houston Housing Market Holds Steady in April Despite Broader Economic Uncertainty

The Greater Houston housing market showed continued resilience in April 2025, with home sales and prices remaining largely unchanged from a year ago. Despite ongoing concerns in national markets, the local real estate landscape remains remarkably balanced, according to the latest data from the Houston Association of Realtors (HAR).

Marginal Changes in Sales and Prices

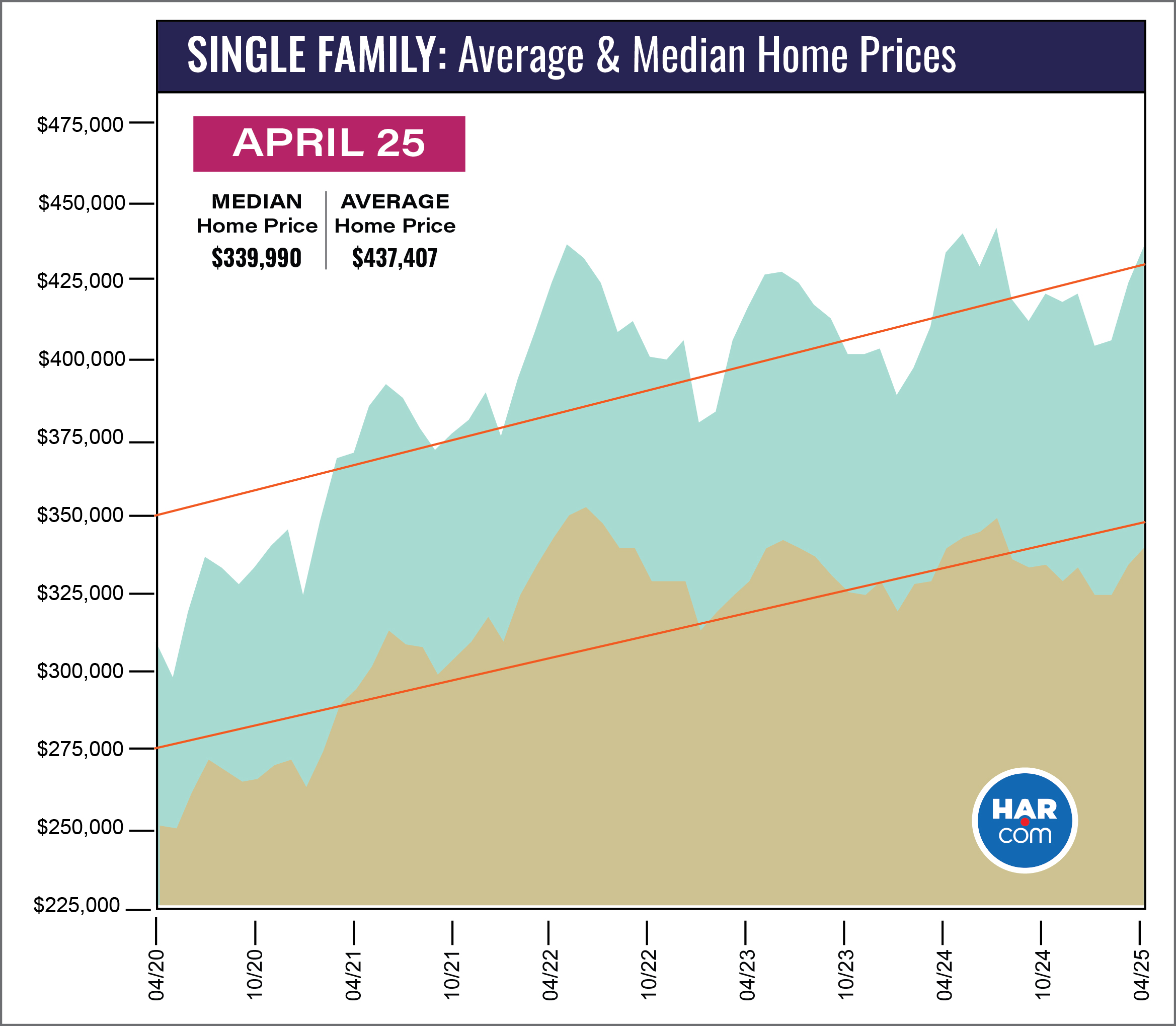

Single-family home sales across the Houston metropolitan area saw a modest year-over-year decline of just 1.1%, with 7,856 homes sold in April compared to 7,940 in the same month last year. The average sales price held steady at $437,407, while the median price showed little movement at $339,990. These figures indicate that Houston continues to offer price stability even as other major housing markets experience more dramatic swings.

HAR Chair Shae Cottar of LPT Realty emphasized the region's steady performance, stating, “While national housing market trends may be showing signs of increased volatility due to economic uncertainty, the Houston area remains on solid footing. The consistent pricing and growth in inventory offer a balanced perspective. For buyers, this typically means less competition and more opportunities to find a home that meets their specific needs and budget. For sellers, it emphasizes the importance of competitive pricing and effective marketing to stand out.”

(Source: HAR.com)

(Source: HAR.com)Inventory Reaches 14-Year High

One of the most significant developments in April was the sharp rise in active listings. The number of single-family homes on the market surged by 37% year-over-year to 34,989 — the highest level since August 2010. Inventory for all property types increased 30.3%, reaching 54,978 available listings across the region.

Months of inventory — a key indicator of market balance — rose to 4.9 months for single-family homes, up from 3.6 months a year ago and surpassing the national average of 4.0 months. The average time it took to sell a home also increased slightly, climbing from 50 to 54 days.

Housing Segment Breakdown

Sales were mixed across different price segments. Lower-end homes priced under $100,000 saw a 14.9% increase in sales, and properties between $150,000 and $249,999 rose 3.0%. The luxury segment, with homes priced over $1 million, also experienced a 1.6% uptick. However, homes in the $100,000–$149,999 range and mid-tier properties between $250,000–$999,999 saw declines.

Mobile Sidebar Ad

Pending sales, often a sign of future activity, rose 13.6%, suggesting that the momentum heading into late spring remains strong.

Existing Homes and Condos: A Mixed Bag

Existing home sales held firm at 5,598 closings, almost identical to the 5,616 transactions recorded in April 2024. The average price for existing homes rose slightly by 2.0% to $450,755, while the median price was flat at $336,063.

In contrast, the townhome and condominium segment continues to lag. Sales dropped 15.2% year-over-year, with only 451 units sold. Prices also softened — the average price fell 4.0% to $267,507, and the median price declined 6.5% to $215,000. However, inventory in this category expanded significantly, now representing a 7.4-month supply, the highest since October 2011.

Mobile Sidebar Ad

Outlook: Balanced Market Favors Both Buyers and Sellers

Despite a slight dip in total dollar volume — down 2.0% to $3.9 billion — the overall picture for Houston’s real estate market is one of stability and opportunity. With more inventory, steady prices, and growing buyer interest as reflected in pending sales, both buyers and sellers are in a position to make informed and strategic decisions.

HAR’s April 2025 Rental Home Update, which will be released on May 21, is expected to offer further insights into local housing dynamics as the summer season approaches.

Tiffany Krenek has been on the My Neighborhood News team since August 2021. She is passionate about curating and sharing content that enriches the lives of our readers in a personal, meaningful way. A loving mother and wife, Tiffany and her family live in the West Houston/Cypress region.

Tiffany Krenek has been on the My Neighborhood News team since August 2021. She is passionate about curating and sharing content that enriches the lives of our readers in a personal, meaningful way. A loving mother and wife, Tiffany and her family live in the West Houston/Cypress region.