2025 Williamsburg Settlement Maintenance Assessment to Remain at $750

At its September 17, 2024 meeting your Board of Directors finalized the 2025 Williamsburg Settlement Homeowners’ Association budget. After review and discussion of both the reserve requirement for the long-term sustainability of our subdivision as well as the ongoing operational expenditures, the decision was made to hold the assessment for 2025 at its present value of $750.00 per home. The budget shows that our predicted expenses will exceed revenue by $27,218, most of which is the second year cost of the cameras at our entrances. This shortfall can be accommodated by a reduction in our operating reserve.

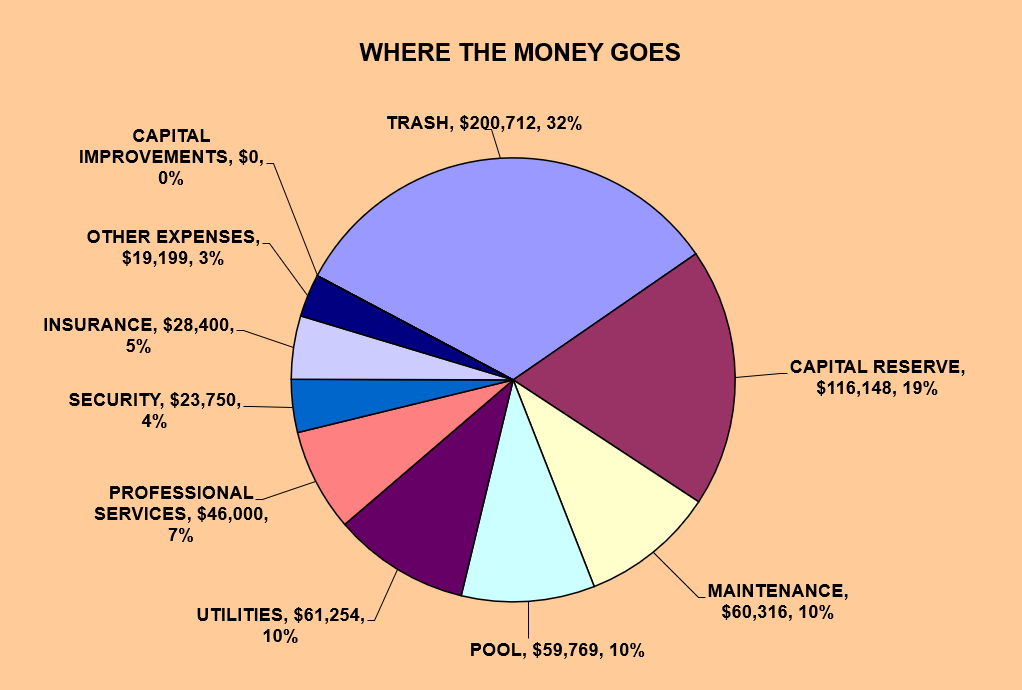

This pie chart illustrates the relative significance of each cost category and the table below it lists the amount forecasted in each income and cost category. This data together with that for the previous four years is also shown in the Budget section of the Association website https://www.wsmaonline.org/ where you can review it at any time.

2025 APPROVED BUDGET

|

INCOME

|

|

|

Maintenance Fee Income

|

572,850

|

|

Delinquency

|

(5,722)

|

|

Interest on Fees

|

1,200

|

|

Bank Interest

|

11,573

|

|

Reimbursed Attorney Fees

|

2,000

|

|

Club Income

|

4,490

|

|

Miscellaneous

|

1,950

|

|

TOTAL REVENUE

|

588,341

|

|

EXPENSES

|

|

|

MAINTENANCE

|

|

|

Sprinkler System Repair

|

2,000

|

|

Landscape Contract

|

33,072

|

|

Landscape Extras

|

10,005

|

|

Forced Mows

|

350

|

|

Pest Control

|

2,739

|

|

Cleaning Services and Supplies

|

1,090

|

|

Tennis Court Maintenance

|

3,000

|

|

Playground Maintenance

|

2,000

|

|

Basketball Court Maintenance

|

40

|

|

Clubhouse Repairs

|

2,520

|

|

Fence Repairs

|

3,000

|

|

Flag Maintenance

|

500

|

|

TOTAL MAINTENANCE

|

60,316

|

|

POOL

|

|

|

Pool Contract

|

52,769

|

|

Pool Maintenance & Repairs

|

5,400

|

|

Pool Tags

|

1,600

|

|

TOTAL POOL

|

59,769

|

|

PROFESSIONAL SERVICES

|

|

|

Audit and tax Return

|

2,300

|

|

Legal

|

1,500

|

|

Legal - Deed Restriction Enforcement

|

3,000

|

|

Legal - Maintenance Fee Collection

|

8,000

|

|

Administrative Services

|

31,200

|

|

TOTAL PROFESSIONAL SERVICES

|

46,000

|

|

UTILITIES

|

|

|

Power - Street Lights

|

37,008

|

|

Power - Recreation Center

|

11,149

|

|

Power - Entry

|

1,147

|

|

Telephone

|

960

|

|

Water/Sewer Clubhouse

|

5,060

|

|

Water – Entrances & Cul-de-sacs

|

5,930

|

|

TOTAL UTILITIES

|

61,254

|

|

TRASH

|

|

|

Trash and Recycling

|

200,712

|

|

TOTAL TRASH

|

200,712

|

|

SECURITY

|

|

|

License Plate Readers at Entrances

|

23,750

|

|

TOTAL SECURITY

|

23,750

|

|

INSURANCE

|

|

|

Insurance

|

28,400

|

|

TOTAL INSURANCE

|

28,400

|

|

OTHER EXPENSES

|

|

|

Record Storage Fee

|

720

|

|

Office Supplies

|

312

|

|

Copies

|

3,200

|

|

Postage

|

4,400

|

|

Distribution

|

350

|

|

Deed Restriction Expenses

|

1,500

|

|

Community Events

|

3,800

|

|

Welcoming Committee Expenses

|

200

|

|

Christmas Decorations

|

2,500

|

|

Memberships & Web Site

|

424

|

|

Miscellaneous/Contingency

|

1,793

|

|

TOTAL OTHER EXPENSES

|

19,199

|

|

CAPITAL IMPROVEMENTS

|

|

|

Including Operating Reserve

|

0

|

|

TOTAL CAPITAL IMPROVEMENTS

|

0

|

|

TAXES

|

|

|

Property Tax

|

11

|

|

TOTAL TAXES

|

11

|

|

|

|

|

TOTAL OPERATING EXPENSES

|

499,411

|

|

RESERVE

|

|

|

Capital Reserve Budget Allocation

|

116,148

|

|

TOTAL EXPENSES PLUS RESERVE

|

615,559

|

|

PROFIT / (LOSS)

|

(27,218)

|